Tampilkan postingan dengan label India Mobile. Tampilkan semua postingan

Tampilkan postingan dengan label India Mobile. Tampilkan semua postingan

Senin, 08 April 2013

Kamis, 04 April 2013

Minggu, 04 Oktober 2009

Justifying tele-density in India ? Are the numbers reported by Indian Telcos inflated?

In some of my older posts, I have shown my concern on the numbers reported for users of mobile service in India. For example with entry of DoCoMo on Indian scene, the numbers Tata reported to have added last month was more than 3 million. Bharti & Vodafone continue to claim the same number of addition that they were claiming in new month. Strangely it means that with entry of new operators the existing will not loose market share. Somewhere fundamentals of economics have been defied. In other words the teledensity in India can reach 100% in ayear or so, if 10 more new operators join, as they will each add 2 to 3 million connection without decrease in the number of additions by existing operators. WoW! It seems the tele density figures in India need to be justified some how.

Recently in one of the articles published in ET,findings of a survey by online market research company JuxtConsult were reported. It says - One out of every three (57 million) urban mobile users in India now own two or more mobile connections. Believe it or not. After all this is a survey. JustConsult claims that it's the first time an estimation on the size of this segment has been attempted, as none of the industry associations––Cellular Operators Association of India (COAI) and Association of Unified Service Providers of India (AUSPI)––or sector regulator Telcom Regulatory Authority of India (Trai) have any estimation of the number of multiple connections per user.

Understanding the size, composition and motivations of this huge segment of mobile users is critical. It is needed by mobile operators in designing their marketing plans. It is also needed by handset makers and department of telecom (DoT), which is in a fix as to estimating the true teledensity of India. JuxtConsult's estimation of mobile connections in the country (till July) at 343-million is lower than TRAI's estimates of 441.6-million (August). JuxtConsult attributes the difference between its estimate and TRAI numbers to many inactive connections. Says Sanjay Tiwari of JuxtConsult: "The discrepancy is also because about 15% of reported additions by mobile operators and their associations are inflated." There are credible reasons behind operators inflating subscriber numbers. Market cap, valuation and spectrum allocation based on number of subscribers are key reasons along with the pressure to cut tariffs. It also helps attract subscribers to one's own network. A new user is likely to join a large operator as network calls come cheap.

ET also reported that the government suspected that all operators were inflating their customer figures by about 15-20% and that the DoT is planning to monitor the user base of all telecom operators to ensure that operators do not inflate subscriber numbers to grab additional spectrum. Well all this will be sorted out shortly - I hope! For the time being Justconsult deserves appreciation for trying to help in profiling the multiple user customer, whose average age largely falls between 25-35 years. According to the survey, Delhi and the national capital region account for over one in ten of all 57-million MCMU’s at 12% of the total base followed by Mumbai (8%), Bangalore (7%) and Chennai (6%). Most are actual genuine connections.

The survey, also for the first time, makes a distinction between a user and a connection, hitherto taken as one in reporting India’s teledensity and average revenue per user. As reported by ET - According to Rajat Mukherjee, chief corporate affair officer at Idea Cellular, about 20% of all telcos’ customers carry more than one SIM. The carried / thrown in dustbin SIMs remains to be distinguished

JuxtConsult’s India Mobile 2009 estimates are based on a very large sample data of around 285,000 urban and rural Indians, covering all states and union territories––574 districts, 3,175 towns and over 2,800 villages. With at least 30 plus sample each from 323 districts and 419 towns, and 100 plus sample each from 184 districts and 155 towns, the study is one of the most representative, independent enumeration of mobile phone usage in India.

With over two mobile connections per user (2.4) amongst multiple connection mobile users (MCMU), this segment account for a majority (59%) of all 235-million odd urban mobile connections. JuxtConsult’s survey did not estimate MCMU numbers for rural India. TOO MUCH TOO SOON !!

With increased urbanisation and migration from distant parts of the country to the cities, long distance calling has been on the rise across the country. ET reports that Airtel will also soon be launching a family plan where in three members of a family can buy Airtel postpaid connection but pay rental for only one. This plan is justified by the survey which shows that joint families have the highest ownership of mobile phones, with about 65% of their members owning more than one connection.

The socio economic class (SEC) A & C mobile users show higher tendency to have multiple connections, says the survey. Migrant workers and youth form a large part of the target audience. This push is also having an impact on more Mobile phone sales and launch of newer models. Sunil Dutt, country head, Samsung Mobile says he is seeing a rise in sales of Samsung’s dual mode GSM/GSM and GSM/CDMA handsets. While Nokia and Sony Ericsson don’t have such phones in the market, Spice Mobiles, has 50% of its portfolio as dual SIM phones. Such phones contribute a good 80% of the company’s revenues, says Kunal Ahooja, CEO, Spice Mobiles. The survey says that about 41% MCMUs need another spare handset for ease of use. But switching between GSM and CDMA handsets is cited as a reason by 30% buyers.

Recently in one of the articles published in ET,findings of a survey by online market research company JuxtConsult were reported. It says - One out of every three (57 million) urban mobile users in India now own two or more mobile connections. Believe it or not. After all this is a survey. JustConsult claims that it's the first time an estimation on the size of this segment has been attempted, as none of the industry associations––Cellular Operators Association of India (COAI) and Association of Unified Service Providers of India (AUSPI)––or sector regulator Telcom Regulatory Authority of India (Trai) have any estimation of the number of multiple connections per user.

Understanding the size, composition and motivations of this huge segment of mobile users is critical. It is needed by mobile operators in designing their marketing plans. It is also needed by handset makers and department of telecom (DoT), which is in a fix as to estimating the true teledensity of India. JuxtConsult's estimation of mobile connections in the country (till July) at 343-million is lower than TRAI's estimates of 441.6-million (August). JuxtConsult attributes the difference between its estimate and TRAI numbers to many inactive connections. Says Sanjay Tiwari of JuxtConsult: "The discrepancy is also because about 15% of reported additions by mobile operators and their associations are inflated." There are credible reasons behind operators inflating subscriber numbers. Market cap, valuation and spectrum allocation based on number of subscribers are key reasons along with the pressure to cut tariffs. It also helps attract subscribers to one's own network. A new user is likely to join a large operator as network calls come cheap.

ET also reported that the government suspected that all operators were inflating their customer figures by about 15-20% and that the DoT is planning to monitor the user base of all telecom operators to ensure that operators do not inflate subscriber numbers to grab additional spectrum. Well all this will be sorted out shortly - I hope! For the time being Justconsult deserves appreciation for trying to help in profiling the multiple user customer, whose average age largely falls between 25-35 years. According to the survey, Delhi and the national capital region account for over one in ten of all 57-million MCMU’s at 12% of the total base followed by Mumbai (8%), Bangalore (7%) and Chennai (6%). Most are actual genuine connections.

The survey, also for the first time, makes a distinction between a user and a connection, hitherto taken as one in reporting India’s teledensity and average revenue per user. As reported by ET - According to Rajat Mukherjee, chief corporate affair officer at Idea Cellular, about 20% of all telcos’ customers carry more than one SIM. The carried / thrown in dustbin SIMs remains to be distinguished

JuxtConsult’s India Mobile 2009 estimates are based on a very large sample data of around 285,000 urban and rural Indians, covering all states and union territories––574 districts, 3,175 towns and over 2,800 villages. With at least 30 plus sample each from 323 districts and 419 towns, and 100 plus sample each from 184 districts and 155 towns, the study is one of the most representative, independent enumeration of mobile phone usage in India.

With over two mobile connections per user (2.4) amongst multiple connection mobile users (MCMU), this segment account for a majority (59%) of all 235-million odd urban mobile connections. JuxtConsult’s survey did not estimate MCMU numbers for rural India. TOO MUCH TOO SOON !!

With increased urbanisation and migration from distant parts of the country to the cities, long distance calling has been on the rise across the country. ET reports that Airtel will also soon be launching a family plan where in three members of a family can buy Airtel postpaid connection but pay rental for only one. This plan is justified by the survey which shows that joint families have the highest ownership of mobile phones, with about 65% of their members owning more than one connection.

The socio economic class (SEC) A & C mobile users show higher tendency to have multiple connections, says the survey. Migrant workers and youth form a large part of the target audience. This push is also having an impact on more Mobile phone sales and launch of newer models. Sunil Dutt, country head, Samsung Mobile says he is seeing a rise in sales of Samsung’s dual mode GSM/GSM and GSM/CDMA handsets. While Nokia and Sony Ericsson don’t have such phones in the market, Spice Mobiles, has 50% of its portfolio as dual SIM phones. Such phones contribute a good 80% of the company’s revenues, says Kunal Ahooja, CEO, Spice Mobiles. The survey says that about 41% MCMUs need another spare handset for ease of use. But switching between GSM and CDMA handsets is cited as a reason by 30% buyers.

Sabtu, 26 September 2009

In terms of mobile minutes, Bharti Airtel is world's fifth largest operator

Bharti Airtel has latched on to the position of the fifth largest wireless telco globally, ahead of carriers like Sprint Nextel and T-Mobile and Latin American major America Movil. Airtel could trump global operators in providing cheaper calls to its subscribers. The company is way ahead of its global competitors by providing lowest cost per minute of usage.

China Mobile claimed the numero uno position in a recent research report, with 726 billion mobile minutes, followed by Verizon with 226 billion mobile minutes, during the April-June 2009 quarter. AT&T came up third with 166 billion mobile minutes, while Vodafone was in fourth place with 156 billion mobile minutes during the same period. Comparing favourably with global telecom giants, Bharti carried 141 billion mobile minutes on its network, almost twice that of Vodafone Essar, which is not listed in India.

The lowest-cost producer of voice minutes globally ensures a superlative cost structure, which is a key hurdle for challengers and green-field telcos. Bharti Airtel compares favourably with global telecom giants and has carried a total of 140.7 billion voice minutes on its network in 1Q from a single country operation, compared to Vodafone’s total network minutes of 143.6 billion, generated from its operations spanning 30 countries.

China Mobile claimed the numero uno position in a recent research report, with 726 billion mobile minutes, followed by Verizon with 226 billion mobile minutes, during the April-June 2009 quarter. AT&T came up third with 166 billion mobile minutes, while Vodafone was in fourth place with 156 billion mobile minutes during the same period. Comparing favourably with global telecom giants, Bharti carried 141 billion mobile minutes on its network, almost twice that of Vodafone Essar, which is not listed in India.

The lowest-cost producer of voice minutes globally ensures a superlative cost structure, which is a key hurdle for challengers and green-field telcos. Bharti Airtel compares favourably with global telecom giants and has carried a total of 140.7 billion voice minutes on its network in 1Q from a single country operation, compared to Vodafone’s total network minutes of 143.6 billion, generated from its operations spanning 30 countries.

Minggu, 19 Juli 2009

Indian GSM operators add 9 million users in June

India’s GSM-based mobile operators added close to nine million users in June, up from 8.3 million in May, as per the data released by GSM operators’ body. The GSM subscriber base stood at 315.7 million in June end. The data compiled by Cellular Operators’ Association of India (COAI) does not include user figures for GSM operator Reliance Telecom. As per COAI, GSM operator Bharti Airtel led in terms of user additions in June, acquiring 2.8 million subscribers. It became the first operator to cross the 100-million subscriber mark, ending the month with 102.3-million users.

Rabu, 14 Januari 2009

Mobile tariffs to lower further in 2009?

As per reports in Economic Times, come 2009, telecom tariffs are set to fall significantly! Sector regulator TRAI on Wednesday set the ball rolling for lower tariffs by seeking the industry's views on reducing the interconnect charges (IUC).

Since IUC charges constitute a significant amount of the call charges, any reduction in this will reflect in a direct fall in tariffs. A reduction in IUC tariffs coupled with increased competition with the entry of several new players could lead to local call tariffs being as low as 10 paise per minute and STD at about 25-35 paise per minute by 2010.

Inetrconnect Usage Charges are those charges that are payable by one telecom operator to the others for use of their networks either for origination, termination or carriage of a call. Inter operator calls constitute a major part of the total calls handled by the telecommunications network. These charges are important as they can transfer network costs between operators and thus affect their relative scale and prosperity.

The current regime is as follows:

Mobile termination charge ranges from Rs 0.13 to Rs 0.30 per minute

Fixed termination charge varies from Rs 0.19 to Rs 0.28 minute

Average Carriage Charges per minute after considering the cost in respect of all NLDOs ranges from Rs 0.16 to Rs 0.72 per minute

These charges were fixed way back in 2002-03 and have not been reviewed since then, even as the overall call tariffs have by over 300% during the same time period.

The regulator will announce a reduction in IUC charges after it receives inputs from the industry.

In addition to lower tariffs, a reduction in IUC charges will also enable several of the new players who were granted telecom licences earlier this year to reduce their operational costs when they launch services. New entrants and some of the existing operators have been demanding a reduction in IUC tariffs for a long time.

Since IUC charges constitute a significant amount of the call charges, any reduction in this will reflect in a direct fall in tariffs. A reduction in IUC tariffs coupled with increased competition with the entry of several new players could lead to local call tariffs being as low as 10 paise per minute and STD at about 25-35 paise per minute by 2010.

Inetrconnect Usage Charges are those charges that are payable by one telecom operator to the others for use of their networks either for origination, termination or carriage of a call. Inter operator calls constitute a major part of the total calls handled by the telecommunications network. These charges are important as they can transfer network costs between operators and thus affect their relative scale and prosperity.

The current regime is as follows:

Mobile termination charge ranges from Rs 0.13 to Rs 0.30 per minute

Fixed termination charge varies from Rs 0.19 to Rs 0.28 minute

Average Carriage Charges per minute after considering the cost in respect of all NLDOs ranges from Rs 0.16 to Rs 0.72 per minute

These charges were fixed way back in 2002-03 and have not been reviewed since then, even as the overall call tariffs have by over 300% during the same time period.

The regulator will announce a reduction in IUC charges after it receives inputs from the industry.

In addition to lower tariffs, a reduction in IUC charges will also enable several of the new players who were granted telecom licences earlier this year to reduce their operational costs when they launch services. New entrants and some of the existing operators have been demanding a reduction in IUC tariffs for a long time.

8 million GSM mobile customers added in Dec 2008 in India

India's GSM players have added over 8 million mobile customers in December 08.

As per the latest data compiled by the Cellular Operators Association of India (COAI), the GSM subscriber base has touched 258 million as of December 2008, up 3.25 % from 249.7 million in November 08. The growth witnessed in December was lead by Bharti Airtel, which added over 2.7 million new users taking its subscriber base to about 87 million. Bharti now commands a market share of 33.22% in the GSM place.

Vodafone Essar with a market share of 23.63% added 2 million subscribers in December 08 taking its total subscriber base to about 60 million. Idea Cellular added close to 1 million subscribers during the same period taking its total subscriber base to 38 million.

State-owned Bharat Sanchar Nigam Limited (BSNL) recorded a positive growth with about over 8 lakh additions in the given period, taking its all India subscriber base to 41 million.

Interestingly, among all circles, category C circle witnessed the highest rate of growth at 3.83%, followed by category B circle at 3.56%, with metros recording the lowest growth rate of 2.3%.

As per the latest data compiled by the Cellular Operators Association of India (COAI), the GSM subscriber base has touched 258 million as of December 2008, up 3.25 % from 249.7 million in November 08. The growth witnessed in December was lead by Bharti Airtel, which added over 2.7 million new users taking its subscriber base to about 87 million. Bharti now commands a market share of 33.22% in the GSM place.

Vodafone Essar with a market share of 23.63% added 2 million subscribers in December 08 taking its total subscriber base to about 60 million. Idea Cellular added close to 1 million subscribers during the same period taking its total subscriber base to 38 million.

State-owned Bharat Sanchar Nigam Limited (BSNL) recorded a positive growth with about over 8 lakh additions in the given period, taking its all India subscriber base to 41 million.

Interestingly, among all circles, category C circle witnessed the highest rate of growth at 3.83%, followed by category B circle at 3.56%, with metros recording the lowest growth rate of 2.3%.

Sabtu, 20 Oktober 2007

Stampede of companies hoping to get new telco operating license (& hence the spectrum) in India

More than 500 companies have applied for new telco operating licenses in India. AT&T was one those who applied just before the closing bell for applications.

If AT&T should get the license, it would set the stage for a battle royale between it and Vodafone for a share of the world's fastest-growing cellular market.

AT&T's wireless unit, the former Cingular, is of course already in a death match in the United States with Vodafone because Vodafone owns 40 percent of Verizon Wireless. An extension of that battle to India, where cellular-phone use is growing at an estimated eight million subscribers per month, thus would have the industry worldwide on the edge of its seats.

Just to make things even more interesting, Sistema, the owner of Russia's largest wireless carrier, Mobile TeleSystems (MTS), also has applied for an Indian cellular license. There's also some suspicion that, buried in the pile of 500 applications, are papers from proxies for other Tier One cellular players on the world stage.

While DoT is scratching its head over how to decide which of the applicants should get licenses - it hadn't expected to need a process to sort through hundreds of applications. Planning is said to center around a two-stage procedure, most likely the initially weeding out those whose goal is to get a license simply to resell it, instantly becoming quite rich in the process.

What the flood of applicants wants is what's called a Universal Access Services Licence (UASL). Such a license, though, doesn't come with any spectrum; that will be a separate - and potentially expensive - issue. Indeed, there are said to be more than 20 Indian companies that last year were allowed to buy licenses, but they aren't in the cellular business yet because they haven't gotten any spectrum.

At this point, the Indian authorities haven't said exactly what spectrum they eventually will put on offer, although the widespread expectation is they will be looking at channels for 3G and possibly 4G service offerings.

In an almost identical arrangement, Vodafone is paired with India's Essar Group - having bought the Hutchison Telecommunications International Limited (HTIL) stake in what had been Hutchison-Essar earlier this year (TelecomWeb news break, Feb. 12). Vodafone-Essar, though, already is a licensed cellular carrier in India - with Number Three market share as is Idea, sitting in the sixth spot. In all, there are 13 wireless competitors in the market (10 of them offering GSM, three CDMA and one both), although most do not have licenses and spectrum that cover the entire country.

The list of applicants is known to include at least eight major real-estate firms in India.

If AT&T should get the license, it would set the stage for a battle royale between it and Vodafone for a share of the world's fastest-growing cellular market.

AT&T's wireless unit, the former Cingular, is of course already in a death match in the United States with Vodafone because Vodafone owns 40 percent of Verizon Wireless. An extension of that battle to India, where cellular-phone use is growing at an estimated eight million subscribers per month, thus would have the industry worldwide on the edge of its seats.

Just to make things even more interesting, Sistema, the owner of Russia's largest wireless carrier, Mobile TeleSystems (MTS), also has applied for an Indian cellular license. There's also some suspicion that, buried in the pile of 500 applications, are papers from proxies for other Tier One cellular players on the world stage.

While DoT is scratching its head over how to decide which of the applicants should get licenses - it hadn't expected to need a process to sort through hundreds of applications. Planning is said to center around a two-stage procedure, most likely the initially weeding out those whose goal is to get a license simply to resell it, instantly becoming quite rich in the process.

What the flood of applicants wants is what's called a Universal Access Services Licence (UASL). Such a license, though, doesn't come with any spectrum; that will be a separate - and potentially expensive - issue. Indeed, there are said to be more than 20 Indian companies that last year were allowed to buy licenses, but they aren't in the cellular business yet because they haven't gotten any spectrum.

At this point, the Indian authorities haven't said exactly what spectrum they eventually will put on offer, although the widespread expectation is they will be looking at channels for 3G and possibly 4G service offerings.

In an almost identical arrangement, Vodafone is paired with India's Essar Group - having bought the Hutchison Telecommunications International Limited (HTIL) stake in what had been Hutchison-Essar earlier this year (TelecomWeb news break, Feb. 12). Vodafone-Essar, though, already is a licensed cellular carrier in India - with Number Three market share as is Idea, sitting in the sixth spot. In all, there are 13 wireless competitors in the market (10 of them offering GSM, three CDMA and one both), although most do not have licenses and spectrum that cover the entire country.

The list of applicants is known to include at least eight major real-estate firms in India.

Selasa, 04 September 2007

A case for implementing number portability in India

Well friends the debate on implementation of number portability in India is now almost 3 years old. The issue keeps popping up every time TRAI comes out with some statements. Here are the extracts of my arguments in favor of implementing the same. These were presented at a debate at IIM Bangalore. I have covered them in a post earlier , but am repeating them in view of the currency of the issue. I welcome your comments on the same. -

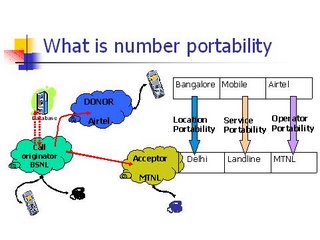

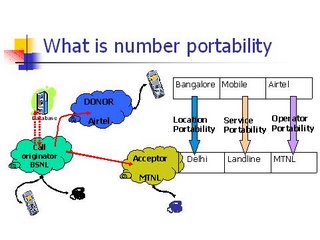

What is number portability (NP)?

Number Portability

allows subscriber to change their service provider to one having –

the best service quality

lower tariff options,

& better network coverage

while retaining their old telephone number.

Technological reasons for implementing

Arguments against implementation - India not yet ready as Implementation requires large technological changes;

My Argument why it should be implemented

Our Mobile network is state of the art; technically much better than many countries where MNP is already working

We introduced many services ahead of even developing countries e.g. GPRS

Fixed line NP may have problems; can be sorted and taken up in next stage

If it can work in S Korea – 2004; Greece – 2004; Lithuania – 2005; Belgium – 2000; Honk Kong - 1998

why not in India

Arguments against implementation - India not yet ready as Our tele-density is still much below developed countries; We should concentrate on increasing tele-density; We have enough operators for competition

My Argument why it should be implemented

Mobile nos. in India are largely in Urban areas. Our urban tele-density is ~40.

We added almost 18m mobiles in last 3 months. That means urban teledensity has increased over 6 in last three months.

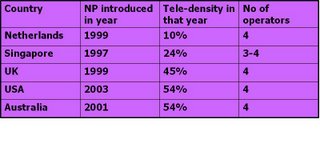

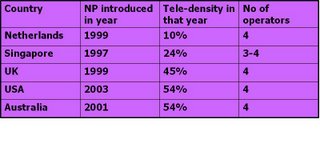

Requires 12-18 months in implementation after decision. Urban tele-density may cross 50 by then. following table indicate that we will be at par or better than developed countries in terms of tele-density for implementing Number Portability(NP)

For one service say GSM mobile we have maximum 4 operators per service area

Economic reasons

Arguments against implementation - Implementation require huge initial investments, which will outweigh the benefits. Rather we should Concentrate on improving service quality

My Argument why it should be implemented

Its exactly the service quality for which we need NP

Today India has one of the lowest rates for mobile services but quality of service offered is poor

NP eliminates pseudo and psychological barriers to churning thus providing truly competitive market and service quality improvement

Some estimate costs as high as 5000 Cr for implementation which are amplified and incorrect estimate even for implementing full fledged NP across services, operators & Locations

Implement just Mobile NP, then go for fixed line

Call forwarding technology does not requires much costs

Even other technologies for mobile number portability we require central database, routing and query arrangements. It will not cost more than 150 cr to implement.

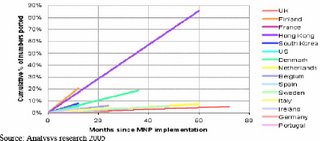

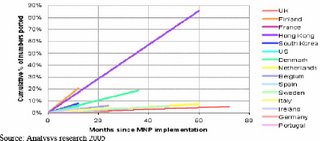

India has 85m mobile connection now. By 2007 they will be more than 150m. Even if 10% use NP we have 15m users. (Spain 3m used.); International Data Corporation India conducted a survey and found that “30% of mobile subscribers are likely to shift to an operator offering better service, if given the option.” Internationally 10% churning of numbers with NP is common as shown in following figure-

Charge of Just Rs 200 can cover costs. Internationally average charges are around 12-14$.

If consumer is ready to pay for better service and availing better tariffs, why it should not be implemented

Operational reasons

Arguments against implementation - Implementation will have problems of distortions by donor networks

My Argument why it should be implemented

Good planning and proper regulations on following issues can help in smooth operations –

Go for all India implementation

Don’t go for call forwarding option

Locking of handsets to be banned

Address lock in period problems

Costs to be collected and born by recipient networks

Operational problems can always be sorted out in time. After all India is not the first country to implement the NP

Conclusion

The US Supreme Court has directed adoption of number portability and India should also follow. The department of telecommunications (DoT) has set April, 2007 as the deadline for the implementation of mobile phone number portability. The deadline had been recommended by the Telecom Regulatory Authority of India (Trai) and submitted to the DoT in March '06

India is well prepared for introducing number portability

It should be introduced in phased manner –

Mobile number portability across the nation amongst all operators

Then fixed number portability

Non implementation of NP will negate the concept of “True market” and operators will go on compromising on service quality standards

What is number portability (NP)?

Number Portability

allows subscriber to change their service provider to one having –

the best service quality

lower tariff options,

& better network coverage

while retaining their old telephone number.

Technological reasons for implementing

Arguments against implementation - India not yet ready as Implementation requires large technological changes;

My Argument why it should be implemented

Our Mobile network is state of the art; technically much better than many countries where MNP is already working

We introduced many services ahead of even developing countries e.g. GPRS

Fixed line NP may have problems; can be sorted and taken up in next stage

If it can work in S Korea – 2004; Greece – 2004; Lithuania – 2005; Belgium – 2000; Honk Kong - 1998

why not in India

Arguments against implementation - India not yet ready as Our tele-density is still much below developed countries; We should concentrate on increasing tele-density; We have enough operators for competition

My Argument why it should be implemented

Mobile nos. in India are largely in Urban areas. Our urban tele-density is ~40.

We added almost 18m mobiles in last 3 months. That means urban teledensity has increased over 6 in last three months.

Requires 12-18 months in implementation after decision. Urban tele-density may cross 50 by then. following table indicate that we will be at par or better than developed countries in terms of tele-density for implementing Number Portability(NP)

For one service say GSM mobile we have maximum 4 operators per service area

Economic reasons

Arguments against implementation - Implementation require huge initial investments, which will outweigh the benefits. Rather we should Concentrate on improving service quality

My Argument why it should be implemented

Its exactly the service quality for which we need NP

Today India has one of the lowest rates for mobile services but quality of service offered is poor

NP eliminates pseudo and psychological barriers to churning thus providing truly competitive market and service quality improvement

Some estimate costs as high as 5000 Cr for implementation which are amplified and incorrect estimate even for implementing full fledged NP across services, operators & Locations

Implement just Mobile NP, then go for fixed line

Call forwarding technology does not requires much costs

Even other technologies for mobile number portability we require central database, routing and query arrangements. It will not cost more than 150 cr to implement.

India has 85m mobile connection now. By 2007 they will be more than 150m. Even if 10% use NP we have 15m users. (Spain 3m used.); International Data Corporation India conducted a survey and found that “30% of mobile subscribers are likely to shift to an operator offering better service, if given the option.” Internationally 10% churning of numbers with NP is common as shown in following figure-

Charge of Just Rs 200 can cover costs. Internationally average charges are around 12-14$.

If consumer is ready to pay for better service and availing better tariffs, why it should not be implemented

Operational reasons

Arguments against implementation - Implementation will have problems of distortions by donor networks

My Argument why it should be implemented

Good planning and proper regulations on following issues can help in smooth operations –

Go for all India implementation

Don’t go for call forwarding option

Locking of handsets to be banned

Address lock in period problems

Costs to be collected and born by recipient networks

Operational problems can always be sorted out in time. After all India is not the first country to implement the NP

Conclusion

The US Supreme Court has directed adoption of number portability and India should also follow. The department of telecommunications (DoT) has set April, 2007 as the deadline for the implementation of mobile phone number portability. The deadline had been recommended by the Telecom Regulatory Authority of India (Trai) and submitted to the DoT in March '06

India is well prepared for introducing number portability

It should be introduced in phased manner –

Mobile number portability across the nation amongst all operators

Then fixed number portability

Non implementation of NP will negate the concept of “True market” and operators will go on compromising on service quality standards

Selasa, 29 Mei 2007

Vodafone directors resigns from Bharti Airtel's Board

The two Vodafone directors on the Board of Bharti Airtel have left the company following its takeover of Hutch-Essar. Bharti Airtel chairman and managing director Sunil Mittal said that both the directors - Gavin Darby and Paul Donovan - have resigned. In January, the Vodafone directors had abstained from the Board meeting when Vodafone started its pursuit of Hutchison Telecom's stake in Hutch-Essar.

Bharti Airtel has also announced that it has crossed the 40 million-mobile customer milestone. With this, Bharti Airtel becomes the first Indian mobile services provider and it says, the 10th in the world to join an exclusive list of global telecom operators with more than 40 million customers from a single-country.

It took Airtel 11 years to reach the 20 million customer landmark and just another 13 months to add the next 20 million customers. The Company's overall wireless market share catapulted to over 23.2% as of April 2007 from 20.4% as reported in FY06.

Currently, Airtel is present in nearly 4,700 census towns and over 200,000 non-census towns and villages covering 59% of the country's population. The company plans to aggressively roll out more than 30,000 cell sites in FY08 to increase its population coverage to 70%."

Bharti Airtel has also announced that it has crossed the 40 million-mobile customer milestone. With this, Bharti Airtel becomes the first Indian mobile services provider and it says, the 10th in the world to join an exclusive list of global telecom operators with more than 40 million customers from a single-country.

It took Airtel 11 years to reach the 20 million customer landmark and just another 13 months to add the next 20 million customers. The Company's overall wireless market share catapulted to over 23.2% as of April 2007 from 20.4% as reported in FY06.

Currently, Airtel is present in nearly 4,700 census towns and over 200,000 non-census towns and villages covering 59% of the country's population. The company plans to aggressively roll out more than 30,000 cell sites in FY08 to increase its population coverage to 70%."

Sabtu, 19 Mei 2007

Hutch Essar may soon be no. 2 GSM operator - ready to over take BSNL

In April, the cellular subscriber base of Bharti touched 3.88 crore with additions of 17.51 lakh users, followed by BSNL at 2.77 crore with a market share of 22.10 per cent and additions of 3.26 lakh subscribers.

Hutch-Essar has 2.77 crore subscribers, taking its market share to 22.06 per cent and Idea with a market share of 11.60 per cent has 1.45 crore subscribers in April.

Hutch-Essar added 12.61 lakh subscribers in the month of April(against 3.26 of BSNL), while Idea added 5.52 lakh mobile users in the same month. If trend continues , by May end Hutch will over take BSNL as no 2 GSM operator.

Sustaining its aggressive growth in subscriber additions, the GSM-based cellular industry has added over 41 lakh subscribers in April with Bharti Airtel capturing 30.97 per cent of the market share.

With this, the all-India GSM subscriber base has touched 12.55 crore at the end of April 2007 compared to 12.14 crore at the end of March 2007, reflecting a growth rate of 3.40 per cent, the Cellular Operators Association of India (COAI) said in a statement.

CDMA mobile figures are yet to be out.

MTNL's GSM subscriber base in Delhi and Mumbai touched 24.83 lakh, while Spice Telecom has over 28 lakh subscribers.

Aircel's user base in April stood at 59.27 lakh, followed by Reliance Telecom's 43.47 lakh subscribers.

Hutch-Essar has 2.77 crore subscribers, taking its market share to 22.06 per cent and Idea with a market share of 11.60 per cent has 1.45 crore subscribers in April.

Hutch-Essar added 12.61 lakh subscribers in the month of April(against 3.26 of BSNL), while Idea added 5.52 lakh mobile users in the same month. If trend continues , by May end Hutch will over take BSNL as no 2 GSM operator.

Sustaining its aggressive growth in subscriber additions, the GSM-based cellular industry has added over 41 lakh subscribers in April with Bharti Airtel capturing 30.97 per cent of the market share.

With this, the all-India GSM subscriber base has touched 12.55 crore at the end of April 2007 compared to 12.14 crore at the end of March 2007, reflecting a growth rate of 3.40 per cent, the Cellular Operators Association of India (COAI) said in a statement.

CDMA mobile figures are yet to be out.

MTNL's GSM subscriber base in Delhi and Mumbai touched 24.83 lakh, while Spice Telecom has over 28 lakh subscribers.

Aircel's user base in April stood at 59.27 lakh, followed by Reliance Telecom's 43.47 lakh subscribers.

Senin, 07 Mei 2007

India's Reliance Communications has de-activated 5.6 million subscribers in March 2007.

Mandatory subscriber verification norms and resulting deactivation of connections have rejigged market share of telecom operators, hitting Reliance Communications (RCOM) the most. An analysis of the latest data on mobile subscriber base in the country shows that the verification process has also led to a change in India’s GSM:CDMA ratio, making it more skewed in favour of the GSM platform. RCom, India’s second largest private operator, saw the market share going down to 18% from 20.5% as it de-activated 5.6 million subscribers in March.

The deadline for subscriber verification was March 31, 2007, and the recognition of an unverified customer after this deadline would attract a fine of Rs 1,000. Those users who could not be verified were disconnected by telcos. As a result, RCOM reported a subscriber base of over 28 million as of March 2007, 10.6% lower than the previous month’s number. Its CDMA business was the worst affected, depicting a fall of 13% in subscriber base at 24.6 million. RCOM’s GSM user base rose 5.8% to 4.1 million in March.

RCOM was the only mobile services provider among the top five who suffered a drop in the market share. With this, the share of CDMA connections in total mobile subscribers as of March fell to 26.7% from 29.2% a month ago. This implies that less than 27% of users are now on CDMA compared to almost 30% earlier. The total mobile subscriber base in the country rose 2% to 161m in March. The outcome of this was that BSNL has grapped the number two position in the Indian wireless space.

The deadline for subscriber verification was March 31, 2007, and the recognition of an unverified customer after this deadline would attract a fine of Rs 1,000. Those users who could not be verified were disconnected by telcos. As a result, RCOM reported a subscriber base of over 28 million as of March 2007, 10.6% lower than the previous month’s number. Its CDMA business was the worst affected, depicting a fall of 13% in subscriber base at 24.6 million. RCOM’s GSM user base rose 5.8% to 4.1 million in March.

RCOM was the only mobile services provider among the top five who suffered a drop in the market share. With this, the share of CDMA connections in total mobile subscribers as of March fell to 26.7% from 29.2% a month ago. This implies that less than 27% of users are now on CDMA compared to almost 30% earlier. The total mobile subscriber base in the country rose 2% to 161m in March. The outcome of this was that BSNL has grapped the number two position in the Indian wireless space.

600 million mobile users in India by 2011 !!!

According to a new study published by the Centre for Telecoms Research (CTR) London, Mobile phone connections in India will reach 600 million in five years time. The growth will arise from pre-paid connections riding on cedreasing tariffs and handset prices. The report expects urban populations of India to reach high levels of mobile phone saturation in five years time, to the extent where many phone users will have two or more handset connections.

Mobile connections in rural geographies will be constrained by coverage of network infrastructure and affordability of handsets which will limit consumption to no more than 150 million by 2011 - the report says. The report also expects mobile phone users to spend more on mobile data services driven largely by the popularity of Bollywood mobile content (e.g. Ringtones, Icons etc)

Mobile connections in rural geographies will be constrained by coverage of network infrastructure and affordability of handsets which will limit consumption to no more than 150 million by 2011 - the report says. The report also expects mobile phone users to spend more on mobile data services driven largely by the popularity of Bollywood mobile content (e.g. Ringtones, Icons etc)

DoCoMo-Hutch Essar deal to launch i-mode service in India called off

DoCoMo and Hutchison Essar, called off a deal to launch mobile Internet services in India using DoCoMo's technology due to U.K.-based operator Vodafone Group's bid for a controlling stake in Hutchison Essar, a major Indian operator.

NTT DoCoMo is Japan's dominant cellular provider but has seen profits fall as it competes with rivals in the saturated domestic market. While the financial hit from Monday's canceled deal will be small, it is symbolic of how the company has generally struggled to establish new sources of income.

DoCoMo's i-mode service includes technology that lets users send email and view online content via mobile phones. In December, the company and Hutchison Essar had agreed to launch the service in India this year. The company may now considering various other options in India, including tie-ups with other Indian carriers.

India is one of the world's fastest growing telecommunications markets, with about 206 million subscribers currently. Japan has more than 100 million users, but growth is largely stagnant.

NTT DoCoMo is Japan's dominant cellular provider but has seen profits fall as it competes with rivals in the saturated domestic market. While the financial hit from Monday's canceled deal will be small, it is symbolic of how the company has generally struggled to establish new sources of income.

DoCoMo's i-mode service includes technology that lets users send email and view online content via mobile phones. In December, the company and Hutchison Essar had agreed to launch the service in India this year. The company may now considering various other options in India, including tie-ups with other Indian carriers.

India is one of the world's fastest growing telecommunications markets, with about 206 million subscribers currently. Japan has more than 100 million users, but growth is largely stagnant.

Selasa, 01 Mei 2007

Mobile companies in India showed impressive 4th quarter results

The results for the fourth quarter of the 2006-07 fiscal - The three big telecom companies in India Bharti Airtel, Reliance Communications (RCOM) and Idea Cellularthat have reported impressive growth. The market was expecting a double digit growth, though there was concern over a falling average revenue per user (ARPU), following the expansion of companies into smaller cities with lower usage. Also, the mandatory requirement to verify and authenticate the identity of subscribers was expected to impact the reported subscriber base.

However, Idea reported a 48% rise in topline for the full year and a more than two-fold jump in bottomline. The operating margins for the eight established circles remained stable, compared with the previous year.

The Delhi-based Bharti Airtel has also posted growth in sales and profits on Friday. Its topline grew 59%, while bottomline surged 89%. Further, the company reported improved operating efficiencies, compared with the previous year, as operating margins expanded by over 300 basis points (bps).

The Anil Ambani group company RCOM’s operating margin shot up from 24% in the prior year to 40%. The pace of growth reported by the companies can be attributed to the scorching pace at which they are expanding the subscriber base. This has been combined with their ability to keep costs under control. Mobile companies in India are adding about seven million users every month — the fastest anywhere in the world — on the back of lower tariffs. Moreover, the minutes of usage (MOU) per subscriber are also on a rise given the gradual transition of users from fixed telephones to mobile. This has particularly taken care of the falling ARPU. For instance, in the case of Bharti, the ARPU fell 8% from the previous year, while the MOU increased 10%. The telecommunication companies are also keen on expanding into other forms of services, including direct to home (DTH), long distance telephony and broadband offerings. All the three companies have announced capex plans to fund their expansions. The valuations of Bharti, in terms of enterprise value per subscriber, is gradually softening. For instance, post FY07 results, Bharti’s valuation stands at Rs 35,538 per user, compared with Rs 41,500 per subscriber in March. In the case of Idea, it has increased from Rs 20,800 per subscriber to Rs 24,200 per subscriber.

However, Idea reported a 48% rise in topline for the full year and a more than two-fold jump in bottomline. The operating margins for the eight established circles remained stable, compared with the previous year.

The Delhi-based Bharti Airtel has also posted growth in sales and profits on Friday. Its topline grew 59%, while bottomline surged 89%. Further, the company reported improved operating efficiencies, compared with the previous year, as operating margins expanded by over 300 basis points (bps).

The Anil Ambani group company RCOM’s operating margin shot up from 24% in the prior year to 40%. The pace of growth reported by the companies can be attributed to the scorching pace at which they are expanding the subscriber base. This has been combined with their ability to keep costs under control. Mobile companies in India are adding about seven million users every month — the fastest anywhere in the world — on the back of lower tariffs. Moreover, the minutes of usage (MOU) per subscriber are also on a rise given the gradual transition of users from fixed telephones to mobile. This has particularly taken care of the falling ARPU. For instance, in the case of Bharti, the ARPU fell 8% from the previous year, while the MOU increased 10%. The telecommunication companies are also keen on expanding into other forms of services, including direct to home (DTH), long distance telephony and broadband offerings. All the three companies have announced capex plans to fund their expansions. The valuations of Bharti, in terms of enterprise value per subscriber, is gradually softening. For instance, post FY07 results, Bharti’s valuation stands at Rs 35,538 per user, compared with Rs 41,500 per subscriber in March. In the case of Idea, it has increased from Rs 20,800 per subscriber to Rs 24,200 per subscriber.

Minggu, 18 Maret 2007

Doordarshan will be available on Nokia handsets in India

Public broadcaster in India Prasar Bharti and world's largest mobile phone maker Nokia are all set to start a mobile TV pilot project in Indian metro cities, which will enable cellular phone users watch Doordarshan channels on their handsets. Nokia India has entered into a pilot tender with DD to launch the service, which would make DD channels available on select high-end Nokia handset models. During the pilot phase, Doordarshan will test the reception quality of the broadcast coverage. Attendant things like a revenue structure or advertising opportunities will come later.

Nokia's N92 series of handsets are capable of catching television signals. Nokia officials said it is for Doordarshan, which has put up a mobile television platform to set a time frame about commercial launch of their TV on Mobile. The company has N92- the first DVBH (digital video broadcast handheld) device. Adoption of mobile TV will ultimately give way to a more personal and private TV experience than that of traditional broadcast TV, with big implications for users, content providers and advertisers.

Nokia's N92 series of handsets are capable of catching television signals. Nokia officials said it is for Doordarshan, which has put up a mobile television platform to set a time frame about commercial launch of their TV on Mobile. The company has N92- the first DVBH (digital video broadcast handheld) device. Adoption of mobile TV will ultimately give way to a more personal and private TV experience than that of traditional broadcast TV, with big implications for users, content providers and advertisers.

Sabtu, 10 Maret 2007

CAOI demands 50% cut in ADC

Cellular operators have urged the Telecom Regulatory Authority of India to reduce Access Deficit Charge by 50% to Rs 1,600 crore for 2007-08 . In their communication to Trai, COAI, the body representing all GSM operators, has demanded that the incidence of ADC should be completely removed from the domestic consumers, and for 2007-08 , this levy be recovered only from incoming international calls.

Currently ADC (the levy paid by all telecom operators to state-owned BSNL to sustain its rural operations) is charged on all STD, ISD and also on incoming international calls. Operators pay 1.5% of the annual aggregate gross revenues (AGR), Rs 1.60 per minute for all incoming international calls to India and Rs 0.80 per minute for every outgoing ISD call, towards ADC.

Justifying the demand, COAI has represented that as per Trai’s estimates, India will receive 11,376 million minutes of incoming international calls 2006-07 which was a growth of 47% over the previous year. If the same growth rate was maintained, incoming ILD traffic for 2007-08 will be at least around 16,745 million minutes. On this basis, CAOI has projected that an ADC of Rs 1 per minute on incoming ILD calls will be sufficient to meet the ADC requirements for 2007-08 .

Currently ADC (the levy paid by all telecom operators to state-owned BSNL to sustain its rural operations) is charged on all STD, ISD and also on incoming international calls. Operators pay 1.5% of the annual aggregate gross revenues (AGR), Rs 1.60 per minute for all incoming international calls to India and Rs 0.80 per minute for every outgoing ISD call, towards ADC.

Justifying the demand, COAI has represented that as per Trai’s estimates, India will receive 11,376 million minutes of incoming international calls 2006-07 which was a growth of 47% over the previous year. If the same growth rate was maintained, incoming ILD traffic for 2007-08 will be at least around 16,745 million minutes. On this basis, CAOI has projected that an ADC of Rs 1 per minute on incoming ILD calls will be sufficient to meet the ADC requirements for 2007-08 .

Reliance & InterCall enters into tie-up to provide conferencing services

Reliance Communications has entered into an exclusive partnership with Chicago-based InterCall, the world's largest conferencing services provider.

As a part of this strategic tie-up, Reliance Communications has rolled out an unique pan-India integrated audio conferencing service both to and from India to its customers.

Reliance InterCall conferencing transforms a phone connection into a virtual conference room, an online auditorium, an electronic brainstorming session and an audit summit depending upon the requirements, the company said in a statement here on Tuesday.

Presently, over 30,000 organisations and 2,00,000 individual conference leaders around the world make use of InterCall's state-of-the-art conferencing facilities and these will now be available in India both for 'anytime meeting' and for reservation-based' services.

As a part of this strategic tie-up, Reliance Communications has rolled out an unique pan-India integrated audio conferencing service both to and from India to its customers.

Reliance InterCall conferencing transforms a phone connection into a virtual conference room, an online auditorium, an electronic brainstorming session and an audit summit depending upon the requirements, the company said in a statement here on Tuesday.

Presently, over 30,000 organisations and 2,00,000 individual conference leaders around the world make use of InterCall's state-of-the-art conferencing facilities and these will now be available in India both for 'anytime meeting' and for reservation-based' services.

BSNL challenges TRAI's decision to cut port charges

BSNL on 8th march challenged the telecom regulator TRAI's decision to cut port charges in the tribunal TDSAT, saying the reduction in fees will lead to a loss of about Rs 100 crore every year to the company. Telecom Disputes Settlement and Appellate Tribunal accepted the petition and issued a notice to TRAI, directing it to file a reply in two weeks.

The Telecom Regulatory Authority of India by its Telecommunication Interconnection (Port Charges) Amendment Regulation on February 2, 2007 that reduced port connectivity charges by 23-29 per cent.

BSNL's major argument in its petition is - "The TRAI vide its impugned regulation is attempting to modify and substitute its regulation over the interconnect agreements entered into between BSNL and private operators so as to effect an impermissible gain for private operators and loss to BSNL." BSNL also contended that while deciding the port charges, TRAI has not taken into consideration the cost of main equipments installed by it to provide interconnection.

The Telecom Regulatory Authority of India by its Telecommunication Interconnection (Port Charges) Amendment Regulation on February 2, 2007 that reduced port connectivity charges by 23-29 per cent.

BSNL's major argument in its petition is - "The TRAI vide its impugned regulation is attempting to modify and substitute its regulation over the interconnect agreements entered into between BSNL and private operators so as to effect an impermissible gain for private operators and loss to BSNL." BSNL also contended that while deciding the port charges, TRAI has not taken into consideration the cost of main equipments installed by it to provide interconnection.

Tata Teleservice plans to invest Rs 3500 Cr in 2007-08

Tata Teleservices (TTSL) is planning to invest Rs 3,500 crore in the next fiscal for expanding services across the country. TTSL has applied for licences in Jammu and Kashmir, Assam and the rest of the North East. Elaborating on the telco’s expansion plans, CEO Mr Darryl Green has said, “We will add more cell cites and reach out to another 1,000 towns and if we get the spectrum, we will roll out 3G services as well.”

The company has been adding over half a million users every month. Along with subsidiary Tata Teleservices Maharashtra, TTSL has nearly 16 million users in India.

The company has been adding over half a million users every month. Along with subsidiary Tata Teleservices Maharashtra, TTSL has nearly 16 million users in India.

Langganan:

Postingan (Atom)